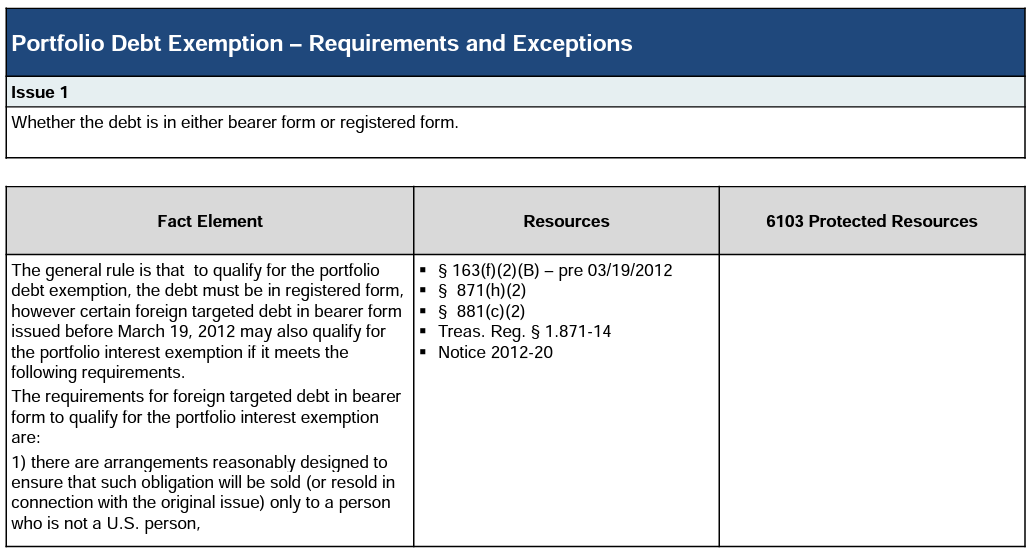

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. This is a tax compliance method utilized by governments to ensure that taxes are remitted properly by a business and on a timely basis.

Bbva Bank Statement Template Mbcvirtual Statement Template Bank Statement Templates

1 Avoid dividend stocks listed in the US.

. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Withholding tax is a method of collecting taxes from non-residents who have derived income which is subject to Malaysian tax. Hence if you wish to invest in US.

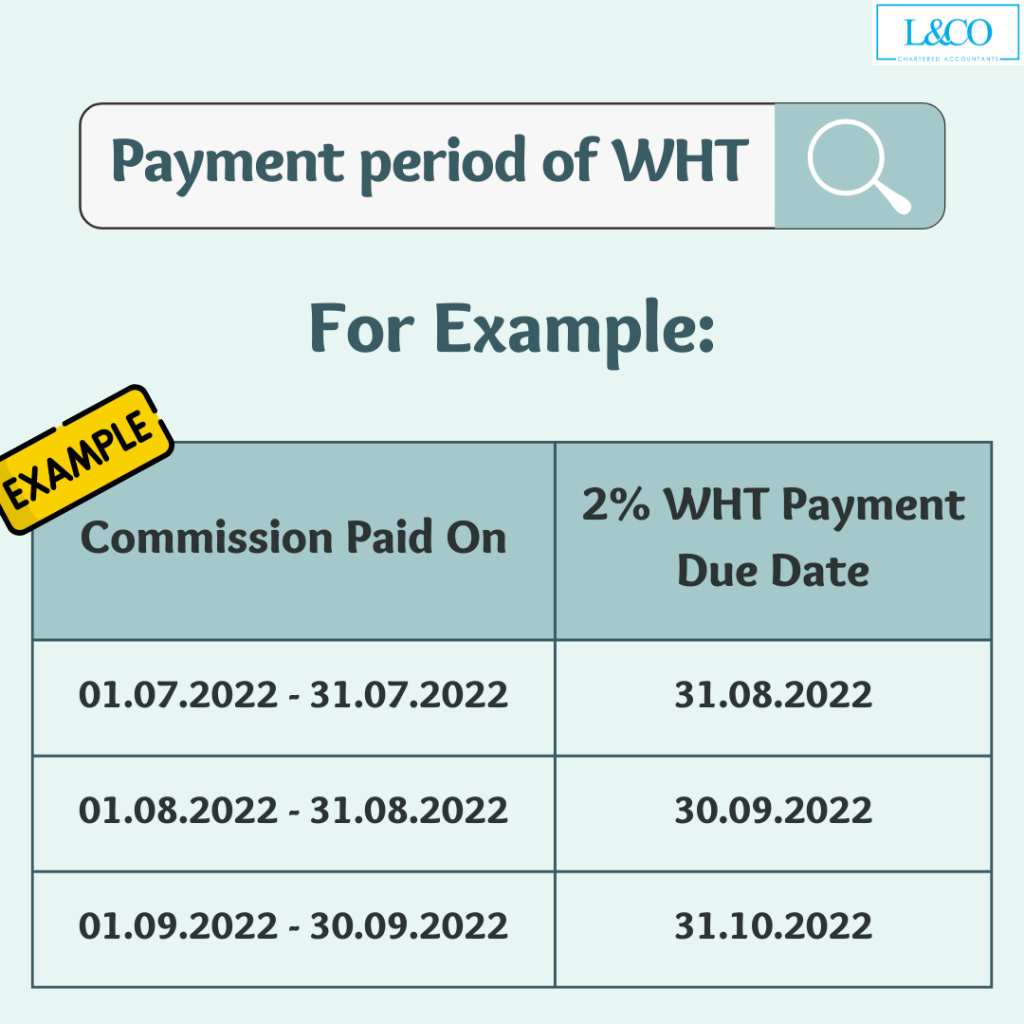

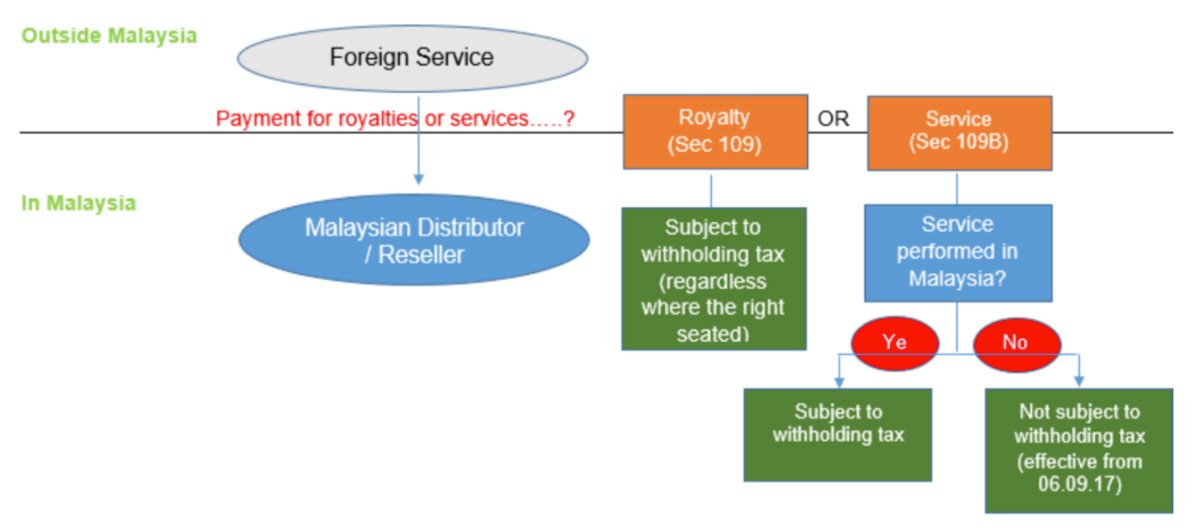

Withholding tax is when a business withholds a portion of a payment for services or goods to a supplier and remits that portion to the government on behalf of its supplier. How to Pay Less Dividend Withholding Tax. Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to the Malaysian IRB within one month of paying.

Withholding tax WHT rates Dividend interest and royalty WHT rates for WWTS territories Statutory WHT rates on dividend interest and royalty payments made by companies in WWTS territories to residents and non-residents are provided. With this law the company has to inform the government on a quarterly basis about income and the amount of withheld tax. The California Form DE 4 Employees Withholding Allowance Certificate must be completed so that you know how much state income tax to withhold from your new employees wagesThe importance of having each employee file a state withholding certificate as well as a federal Form W-4 cannot be overstated so make its completion a priority.

Withholding tax to the Inland Revenue Board of Malaysia IRBM within one month from the date of paying or crediting. What is withholding tax. Exemption from withholding tax on payments of certain reasonable travel expenses and per diem amounts reimbursed to a non-resident actor.

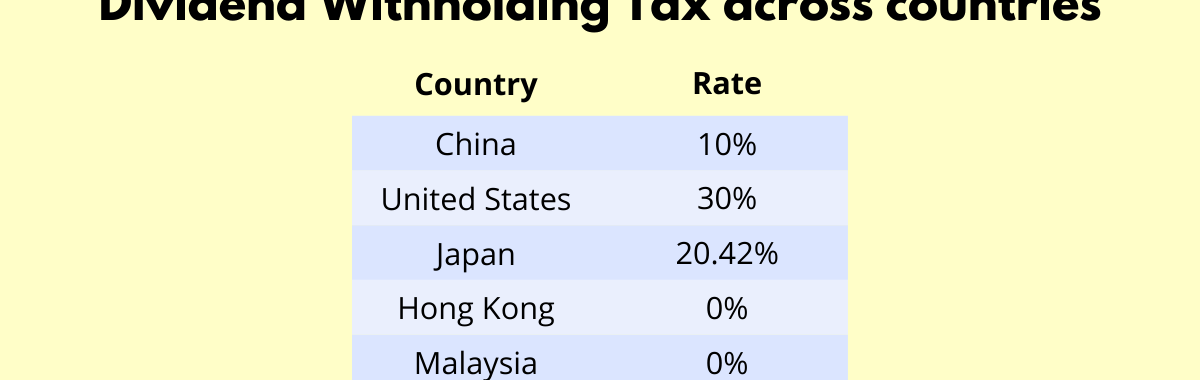

Malaysia has no WHT on dividends in addition to tax on the profits out of which the dividends are declared. Withholding tax is an amount of tax that is being withheld by the payer on the income earned by a non-resident payee check out the detail calculation of withholding tax Malaysia on the tax rate on every type of payment. Interest on loans given to or guaranteed by the Malaysian government is exempt from tax.

There are four ways you can reduce the amount of withholding tax on your dividends. Exemption from withholding tax as a result of other exempting provisions of a tax convention other than those given above in codes I and P through R. The complete texts of the following tax treaty documents are available in Adobe PDF format.

Withholding tax WHT also called retention tax is an obligation on the individual either resident or non-resident to withhold tax when making payments of a specified nature such as rent commission salary for professional services to satisfy contract provisions etc. At rates specified in Indias tax regime. Malaysia indirect tax guide Malaysia indirect tax guide Explore the requirements and rules that apply to indirect taxes in Malaysia.

0 0 or 15 10. Indian Income Tax Act 1961 makes it mandatory for all Indian companies and individuals to Withholding Tax Rates in India on all income earned by Foreign Companies NRI from the Indian sources. Does a reverse charge or indirect tax withholding mechanism apply.

Generally any person making certain payments such as royalties interest contract payments remuneration to a public entertainer technical and management fees to non-residents is required to remit the tax deducted at an applicable rate ie. 0 0 0. Stocks you may want to avoid dividend.

Malaysia Last reviewed 13 June 2022 Resident. Some treaties provide for a maximum WHT on dividends should Malaysia impose such a WHT in the future. Yes businesses are required to self-account for Service Tax on imported services which are in the scope of Service Tax.

If a stock doesnt pay out dividends you are not subjected to the Dividend Withholding Tax.

How Do We Compute Withholding Tax On Compensation Youtube

Withholding Tax Wht Calculation Sap Blogs

U S Dividend Withholding Tax What Singapore Investors Must Know

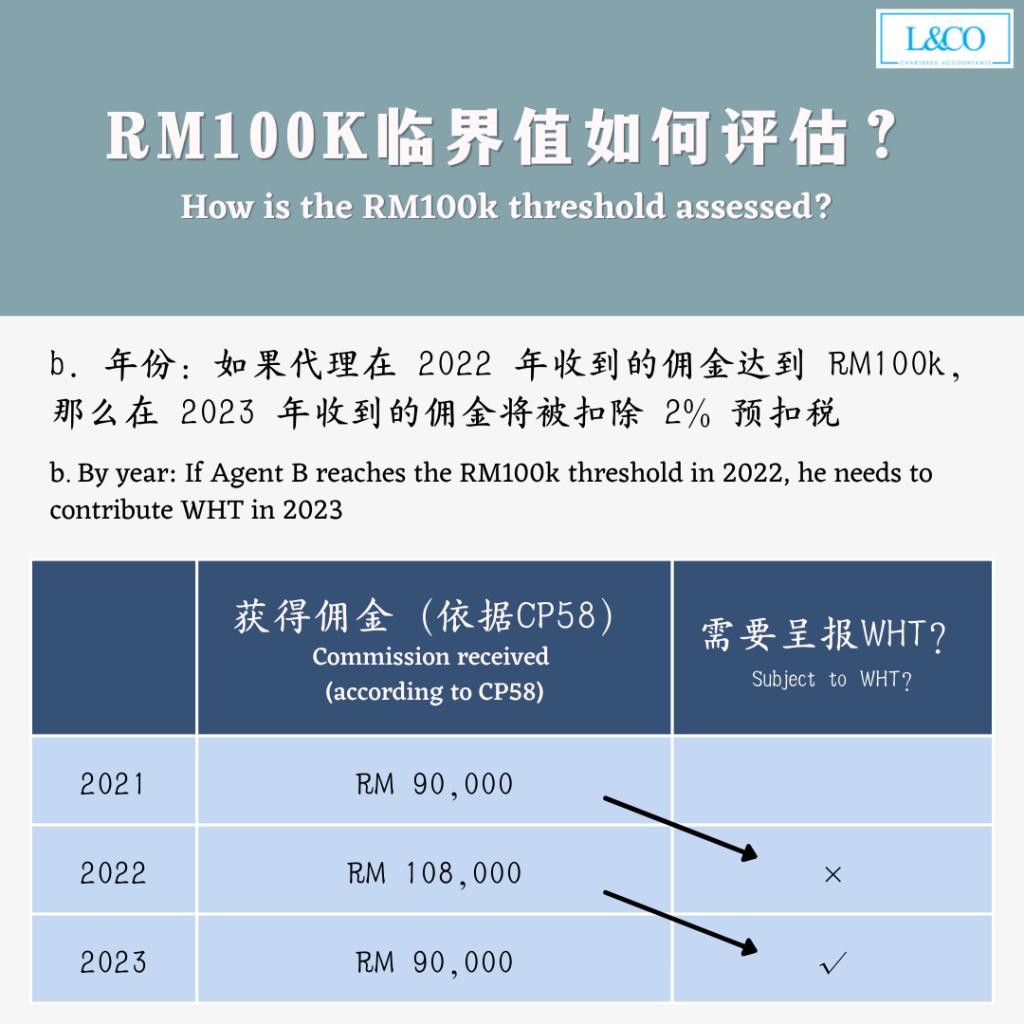

Details Of 2 Agent Commission Withholding Tax L Co

Online Advertising Services Provided By Non Residents Are Subject To Withholding Tax

Introduction To Withholding Tax Imported Services Tax Part 2

Demystifying Malaysian Withholding Tax Re Run Kpmg Malaysia

Payments That Are Subject To Withholding Tax Wt

Extended Withholding Tax Sap Simple Docs

Laravel Training In Karachi 3d Educators Technology Systems Information Technology Development

Details Of 2 Agent Commission Withholding Tax L Co

Portfolio Interest Exemption Advanced American Tax

Understanding Withholding Tax Microsoft Dynamics 365 Enterprise Edition Financial Management Third Edition

Details Of 2 Agent Commission Withholding Tax L Co

Withholding Tax What Is Withholding Tax Youtube

Details Of 2 Agent Commission Withholding Tax L Co

25 Great Pay Stub Paycheck Stub Templates Excel Templates Payroll Template Templates

Customizable And Printable Rent Receipt Templates To Help You Save Time When Creating Receipts Receipt Template Free Receipt Template Templates Printable Free

What Are Employer Taxes And Employee Taxes Gusto